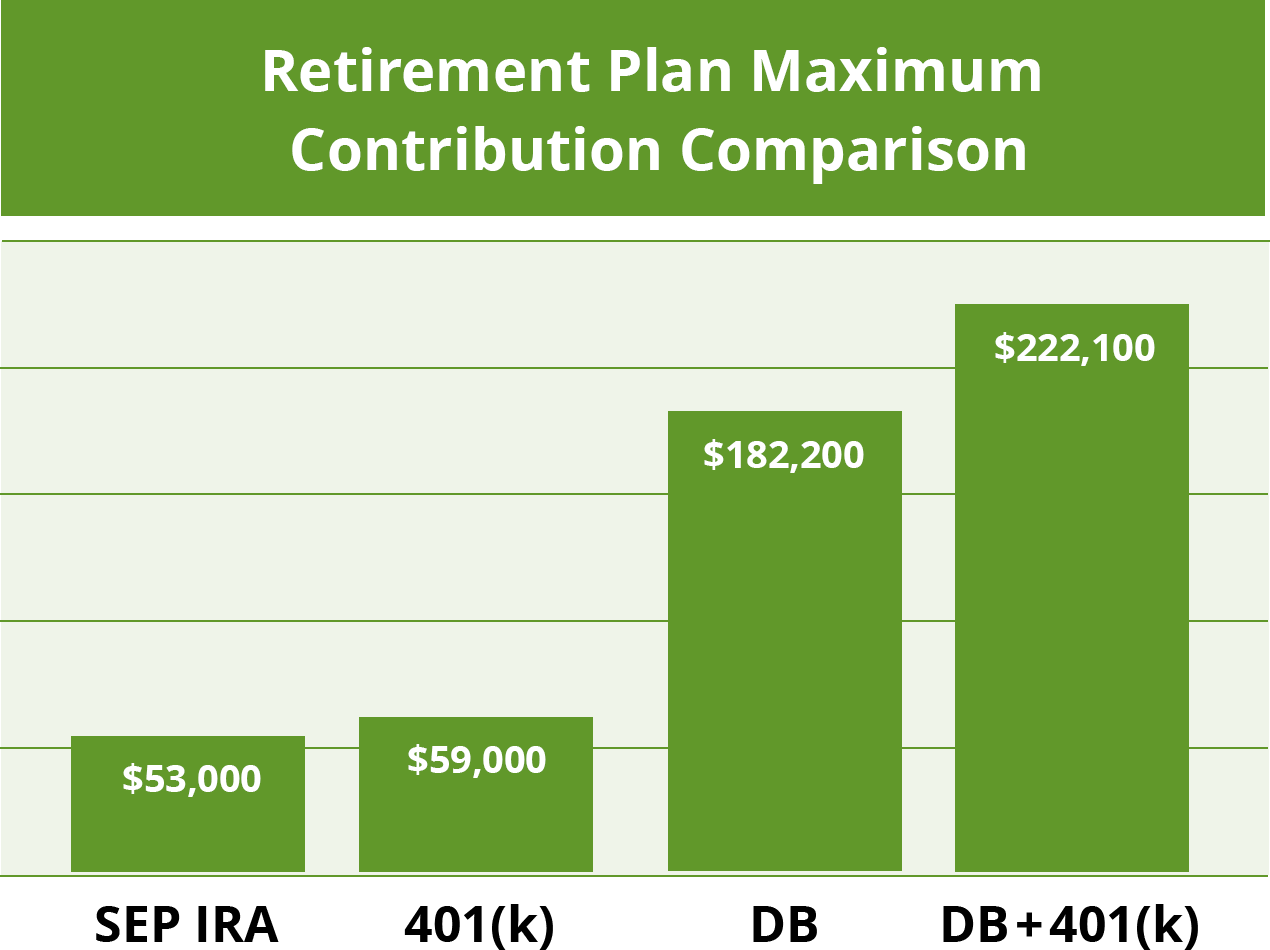

As a self-employed professional, you have unique tax benefits and retirement planning opportunities. Did you know the IRS offers specialized plans allowing significant tax-deductible contributions? At Decision Investments, we help high-earning individuals like you choose the optimal plan to maximize your retirement savings.

Our streamlined process ensures setting up your plan is quick and hassle-free. But a solid plan is just the beginning.

Successful individuals trust Decision Investments’ world-class portfolio management expertise. We meticulously manage your investments, prioritizing risk management and optimal performance to help you achieve your long-term financial goals.

4445 Eastgate Mall #200

San Diego, CA 92121

P. 858-812-3026

F. 858-812-3319

info@decisioninvestments.com