A. We are a fee-only financial advisory firm that provides Portfolio Management, Financial Planning, and 401k advisory services.

A. We charge a specific fee for providing our clients with information or advice and for managing their portfolios. We have no vested interest in and we do not receive commissions from any firm selling financial products. We are objective consultants whose only interest is in providing clients with the most appropriate responses to their financial situation.

A. We don’t design one-size-fits-all portfolios. We work with clients to develop an “asset allocation model,” which is like a blueprint for structuring their investments. It’s based on their individual circumstances, the range of returns required, the limits of acceptable risk, and the timing of contributions and withdrawals.

Furthermore, individual investments such as stocks or bonds can vary from account to account. This seemingly trivial difference to most other firms can often have meaningful impacts on portfolio risk and returns.

A. Preservation of capital through:

To accomplish this, we use our own proprietary research and technology in selecting the right mix of investments for a client’s portfolio. The combination puts our expertise to work for each client.

A. No, the world of investments doesn’t operate that way and there are legal restrictions against making performance guarantees. Markets fluctuate. We project probabilities, not certainties.

A. We would like to think many things differentiate us, but most notably, fee-only services, direct attention to individual client’s portfolios, and active management.

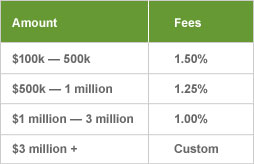

Fees are per annum, billed in four quarterly installments.

You do. You are giving discretionary control to Decision Investments to manage your portfolio. We can only perform the tasks you allow us to do, such as transacting trades and billing your accounts.

Decision Investments never takes possession of your money. Our third-party custodian, Charles Schwab Institutional, holds your funds at all times. This provides a shield of protection between your funds and Decision Investments. Click here for the Schwab Security Guarantee

You bet we do. Keeping you well informed, as well as ongoing education, is part of our service. We provide written quarterly performance reports and review them with you. The reports display both absolute performance as well as a comparison to market benchmarks. We also communicate periodically in between quarterly reviews as the need presents itself.

We’re prepared for that and will redesign your portfolio accordingly. We have structured Decision Investments with individually managed portfolios and a quarterly review process to give us an efficient way of responding to your changing needs.

We’ll be sorry, of course, but your contractual agreement with Decision Investments includes a no-questions-asked termination policy. If for any reason you choose to disengage our advisory services, you leave with no financial obligation. You have no long-term commitment to us and we charge no exit fees.

4445 Eastgate Mall #200

San Diego, CA 92121

P. 858-812-3026

F. 858-812-3319

info@decisioninvestments.com